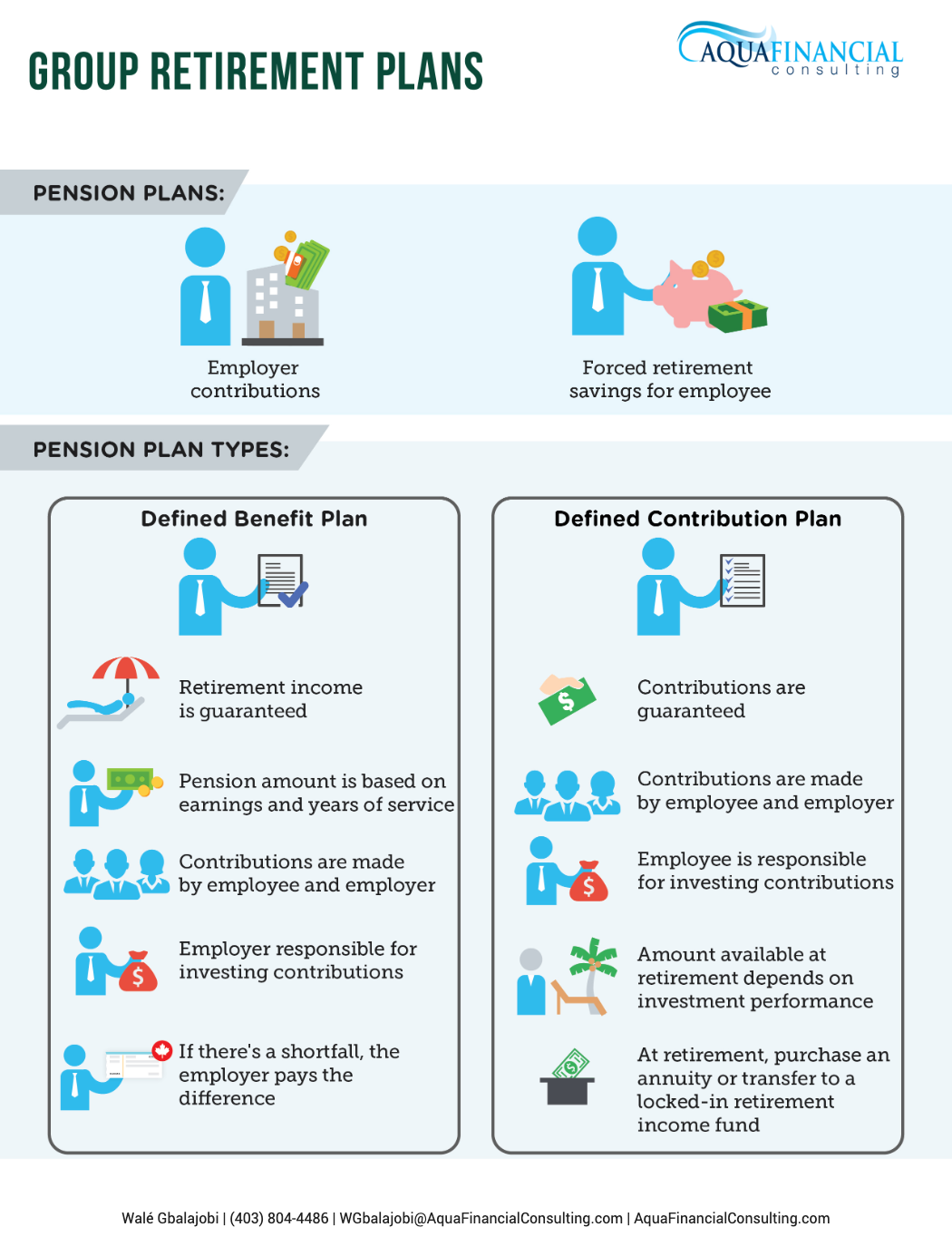

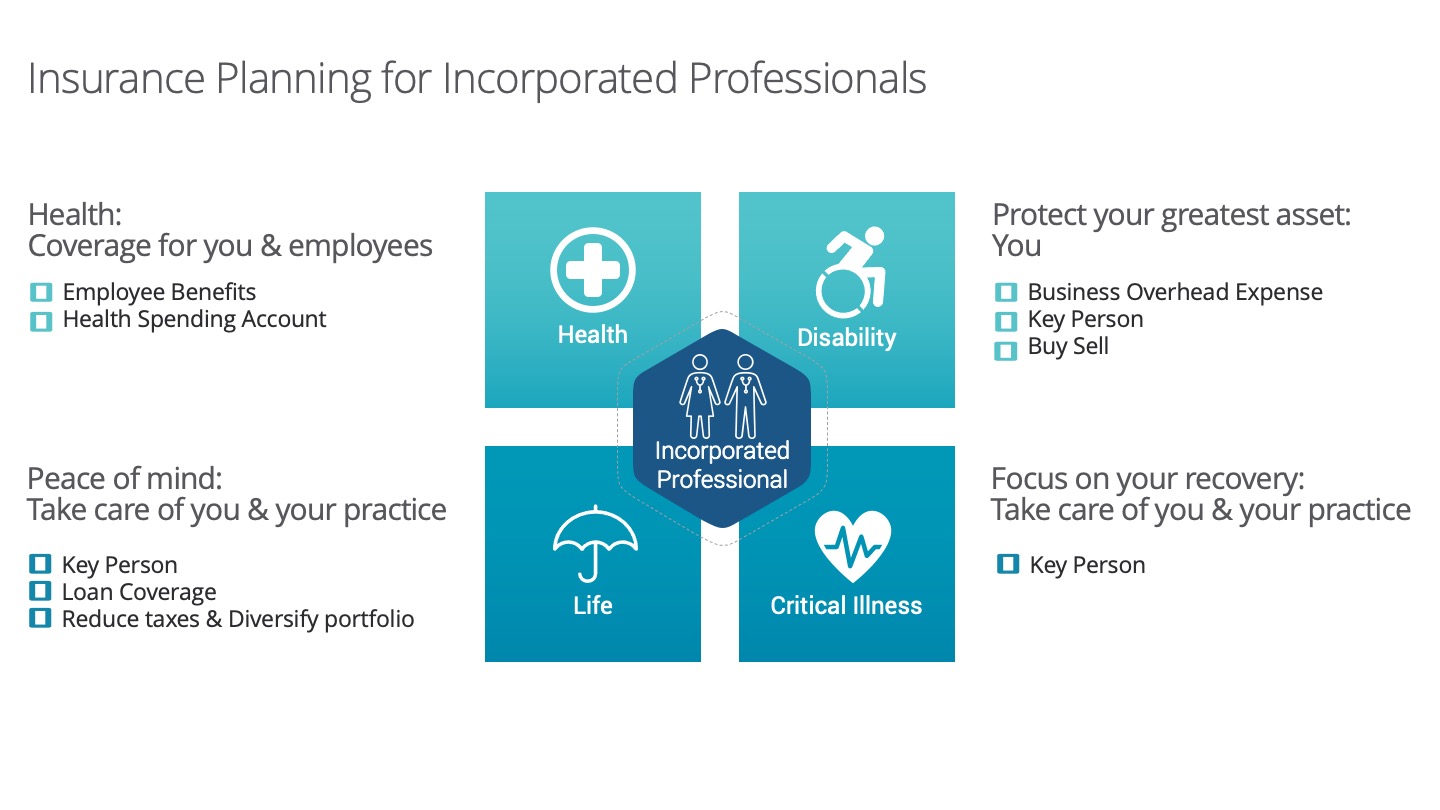

Insurance Planning for Incorporated Professionals

For incorporated professionals, making sure your practice is financially protected can be overwhelming. Incorporated professionals face a unique set of challenges when it comes to managing risk. Insurance can play an important role when it comes to reducing the financial impact on your practice in the case of uncontrollable events such as disability, or critical illness. This infographic and article address the importance of corporate insurance.

The 4 areas of insurance a incorporated professional should take care of are:

-

Health

-

Disability

-

Critical Illness

-

Life

Health: We are fortunate in Canada, where the healthcare system pays for basic healthcare services for Canadian citizens and permanent residents. However, not everything healthcare related is covered, in reality, 30% of our health costs* are paid for out of pocket or through private insurance such as prescription medication, dental, prescription glasses, physiotherapy, etc.

For incorporated professionals, offering employee health benefits make smart business sense because health benefits can form part of a compensation package and can help retain key employees and attract new talent.

For incorporated professionals that are looking to provide alternative health plans in a cost effective manner, you may want to consider a health spending account.

Disability: Most people spend money on protecting their home and car, but many overlook protecting their greatest asset: their ability to earn income. Unfortunately one in three people on average will be disabled for 90 days or more at least once before the age of 65.

Consider the financial impact this would have on your practice if you or a key employee were to suffer from an injury or illness. Disability insurance can provide a monthly income to help keep your practice running.

Business overhead expense insurance can provide monthly reimbursement of expenses during total disability such as rent for commercial space, utilities, employee salaries and benefits, equipment leasing costs, accounting fees, insurance premiums for property and liability, etc.

Key person disability insurance can be used to provide monthly funds for you or key employee while they’re disabled and protect the business from lost revenue while your business finds and trains an appropriate replacement.

Critical Illness: For a lot of us, the idea of experiencing a critical illness such as a heart attack, stroke or cancer can seem unlikely, but almost 3 in 4 (73%) working Canadians know someone who experience a serious illness. Sadly, this can have serious consequences on you, your family and business, with Critical Illness insurance, it provides a lump sum payment so you can focus on your recovery.

Key person critical illness insurance can be used to provide funds to the practice so it can supplement income during time away, cover debt repayment, salary for key employees or fixed overhead expenses.

Buy sell critical illness insurance can provide you with a lump sum payment if your business partner or shareholder were to suffer from a critical illness. These funds can be used to purchase the shares of the partner, fund a buy sell agreement and reassure creditors and suppliers.

Life: For an incorporated professional, not only do your employees depend on you for financial support but your loved ones do too. Life insurance is important because it can protect your practice and also be another form of investment for excess funds.

Key person life insurance can be used to provide a lump sum payment to the practice on death of the insured so it can keep the business going until you an appropriate replacement is found. It can also be used to retain loyal employees by supplying a retirement fund inside the insurance policy.

Loan coverage life insurance can help cover off any outstanding business loans and debts.

Reduce taxes & diversify your portfolio, often life insurance is viewed only as protection, however with permanent life insurance, there is an option to deposit excess funds not needed for operations to provide for tax-free growth (within government limits) to diversify your portfolio and reduce taxes on passive investments.

Talk to us to make sure you and your practice are protected.